Guess Who Pays for Tariffs?

Trump’s tariff policies are obviously controversial. It is true that they are bringing in some new governmet revenue. According to CNBC (and others), tariff revenue in 2025 was $124 billion, a 304% increase over the previous year. However, the New York Times reported today on a study just released by the Federal Reserve Bank of New York that illuminates who exactly is paying these taxes.

Zooming out a bit, the findings from the New York Fed highlight a central debate in trade policy: the trade-off between using tariffs as a tool for industrial strategy (the old Hamiltonian approach) and the resulting inflationary pressure on the domestic economy. While tariffs are often intended to protect local industries or exert geopolitical leverage, this new study underscores the “pass-through” effect, where import taxes act as a de facto consumption tax on Americans. As policymakers weigh the benefits of “de-risking” supply chains and reducing dependence on specific trading partners, they must confront the reality that these structural shifts often come at a direct cost to the purchasing power of domestic businesses and households.

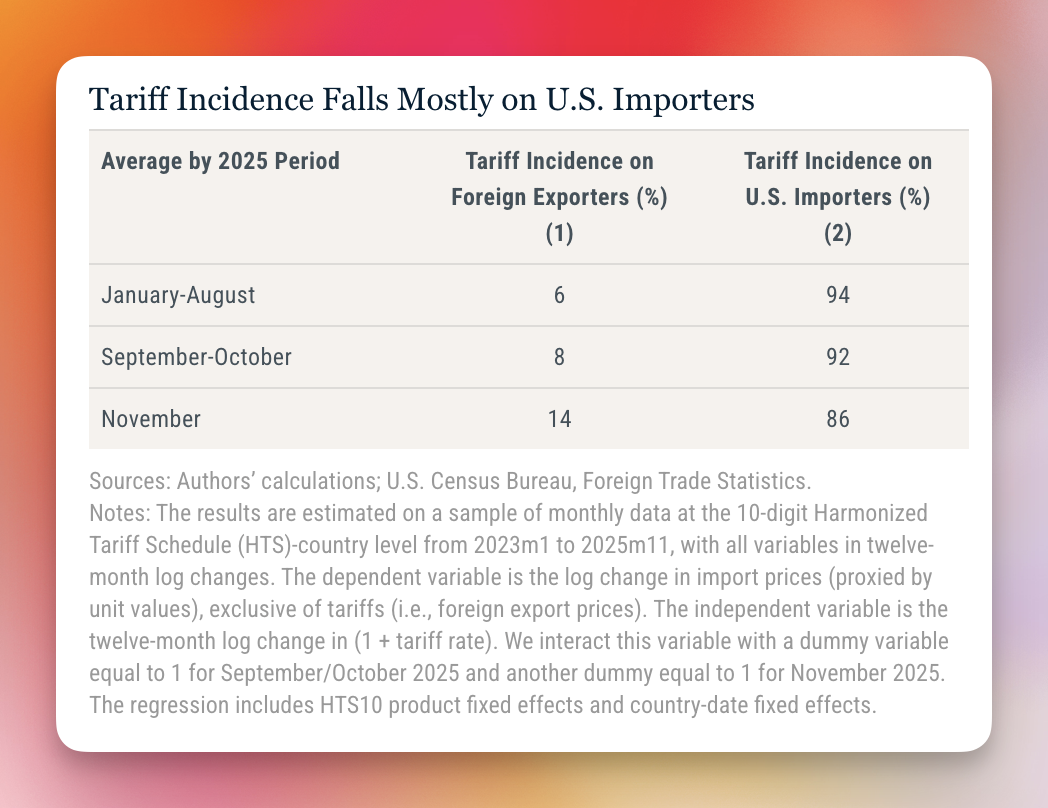

More specifically, the New York Fed study reveals that the vast majority of the economic burden from the 2025 U.S. tariffs (nearly 90 percent!) is being borne by domestic firms and consumers rather than foreign exporters. Apparently, while the average tariff rate spiked from 2.6% to 13% over the year, foreign exporters generally did not lower their prices to absorb the cost. Instead, these costs were passed through to U.S. importers, leading to an 11% increase in prices for goods subject to the average tariff.

So the federal government is raising more revenue, but they are raising it from us.

Note: The graph below is taken from the NY Fed study by Mary Amiti, Chris Flanagan, Sebastian Heise, and David E. Weinstein